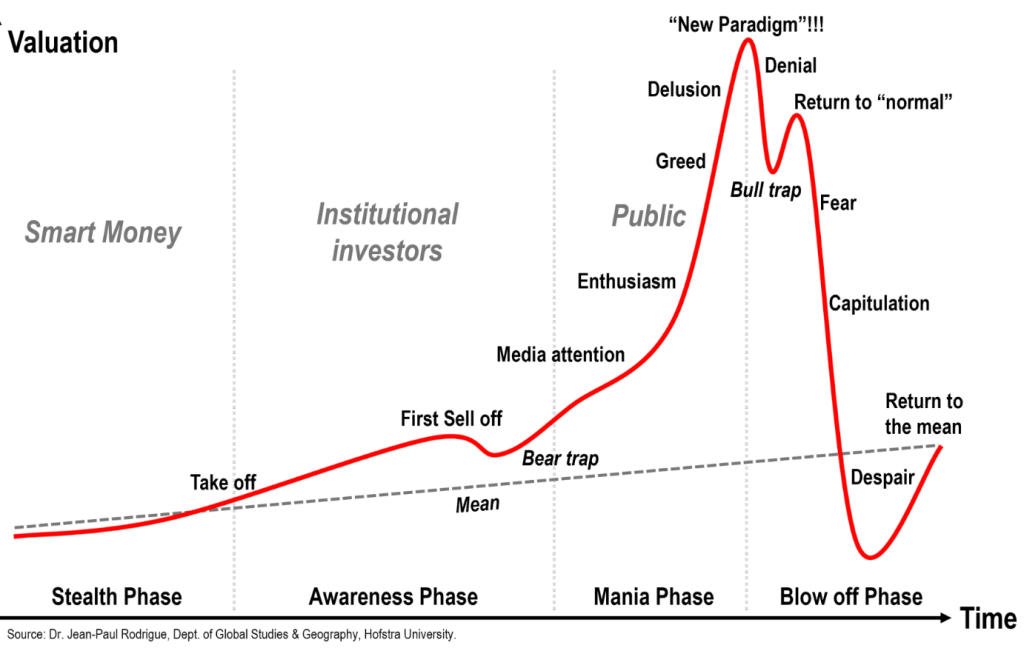

Jeff Currie has a message for investors in the so-called AI revolution. “Looking back at major technological booms, from railroads to the internet to shale, you see similar patterns emerge over time,” he explains.

Even though the technologies can be transformative, investors can still lose a lot of money. Currie puts it more mildly, “Equity investors have not always seen returns that match early expectations.”

Generative AI is widely touted as a technology that will transform our world for good (or perhaps for ill). There is little question that it has captured the zeitgeist: Last year the top AI-related stocks commanded 40 percent of the market capitalization of the S&P 500, fueling an estimated 75 percent of the market’s gains. Not surprisingly, AI investment also accounted for almost half of GDP in the U.S., according to the latest official figures.

For example, Nvidia, whose AI chip business started the boom in late 2023, is now worth almost $5 trillion, its stock having risen almost 300 percent since it took off just over two years ago. OpenAI, the privately held company that created ChatGPT, is valued at $500 billion. But as the sums spent to build out this brave new world’s data centers grow into the trillions, the warnings are also gaining currency.

“There’s a level of skepticism that’s starting to go higher and higher and be louder and louder,” says Herb Greenberg, whose Substack “On the Street” is known for its “red flag alerts” that spot troubled companies. What’s interesting, he says, are the types of people who are speaking up.

Read on to see what Howard Marks, Torsten Slok, Gary Marcus, DAvid Einhorn and Michael Burry are saying–and how it all ties together.

https://www.institutionalinvestor.com/article/now-top-investors-are-doubting-ai-revolution